NHA to Roll Out National Health Claims Exchange by December to Streamline Insurance Claims

Spearheaded by the National Health Authority (NHA), this digital platform is anticipated to significantly reduce the time and expenses involved in insurance claim processing.

In a bid to streamline the often cumbersome process of health insurance claims, India is poised to launch the National Health Claims Exchange (NHCX) by the end of this year.

Spearheaded by the National Health Authority (NHA), this digital platform is anticipated to significantly reduce the time and expenses involved in insurance claim processing.

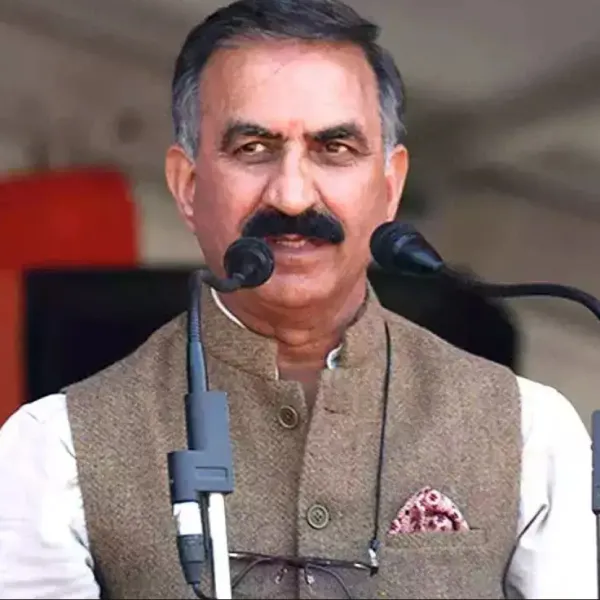

Commenting on the same, Dr Basant Garg, mission director of Ayushman Bharat Digital Mission (ABDM) and additional CEO at NHA, said, "We aimed to demonstrate a functional insurance claims exchange within the next two months."

The NHCX, currently in a sandbox stage, witnessed a pivotal milestone between October 25th and 27th. During this phase, insurance companies and Third Party Administrators (TPAs) showcased their ability to send and receive claims electronically, laying the groundwork for subsequent standardised processing.

Dr Garg said, "Standardisation involves using simple international codes for labs, diseases, and medications. Machine-readable standardized information will expedite claims processing."

Previously, the process entailed manual reading of PDF documents, resulting in prolonged back-and-forth communications, causing delays and increased costs for patients, hospitals, and insurers. Dr Garg indicated that the current estimated processing cost per claim stands at around INR 500, eventually impacting patients.

With the NHCX, a single streamlined gateway will replace multiple software platforms. Dr Garg said, "Claims will be sent through this national exchange, reducing processing time from days to minutes. Costs could drop significantly to around Rs 10-12 per claim."

A significant advantage of this exchange lies in potentially enabling Outpatient Department (OPD) coverage. Dr Garg noted the current unviability of OPD claims due to high processing costs, impacting insurance penetration in the country.

The collaborative efforts of the Insurance Regulatory and Development Authority of India (IRDAI) and NHA, along with key stakeholders such as the Swasth Alliance, contributed to the conceptualisation and design of the claims exchange.

According to Dr Garg, these entities played a pivotal role in the implementation and popularisation of the exchange.

The impending launch of NHCX could potentially transform India's insurance landscape, facilitating a surge in insurance penetration and simplifying the claims process for the benefit of patients, hospitals, and insurance companies.

Experts foresee a significant impact similar to the National Payments Corporation of India (NPCI) in the financial sector. The NHCX could potentially reshape the settlement of financial transactions and healthcare matters, reshaping the insurance ecosystem in the country.

The push for standardisation, coupled with the collaborative efforts of various stakeholders, may pave the way for a more efficient, cost-effective, and accessible healthcare insurance system in India.

In recent times, in September, the Insurance Regulatory and Development Authority of India (IRDAI) has actively collaborated with health insurance providers to expedite the 100% cashless settlement of medical expense claims. This move aims to simplify further and expedite health insurance claim settlements.

Stay tuned for more such updates on Digital Health News