Written by : Dr. Aishwarya Sarthe

July 16, 2024

This appeal aims to establish a predictable tariff policy to reduce India’s 70% dependency on imported medical devices.

The Association of Indian Medical Device Industry (AiMeD) has called on the Union Ministry of Finance to revise and increase the customs duty on 95 items out of approximately 160 listed under the HS Codes of Medical Devices.

This appeal aims to establish a predictable tariff policy to reduce India’s 70% dependency on imported medical devices.

In its pre-budget memorandum, AiMeD emphasized the necessity of nominal tariff protection for domestically produced medical devices.

"A predictable tariff policy is essential to assure nominal protection when capacity is added by a manufacturer,’’ the association stated.

AiMeD proposed that the current basic import tariff of 0-7.5% should be increased to 5-15% for medical devices, with a bound rate under the World Trade Organisation (WTO) agreement set at 40%.

Moreover, the association argued that concessional duty on raw materials, including packaging materials for sterile disposables, should be maintained at 2.5% for the next three years.

This move, the association asserted, would provide significant support to Indian manufacturers struggling to compete with cheaper Chinese imports.

The association also noted the impact of the Goods and Services Tax (GST) on imported devices, which has made them 11% cheaper, further challenging Indian manufacturers.

Additionally, AiMeD recommended expanding the 5% health cess on certain HS codes to include other medical device categories.

"We seek changes for only 95 items out of the total approximately 160 items of listed HS Codes of Medical Devices, and that also as a predictable policy of phased manufacturing plan of assured protection only on evidence-based investment and global competitiveness," the association stated.

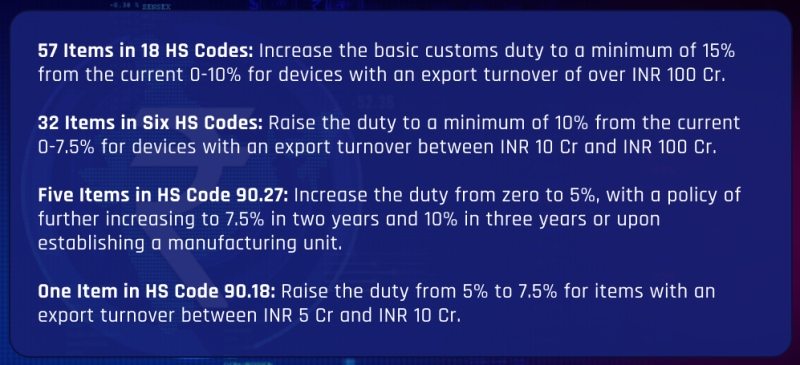

In its submission to the ministry, AiMeD detailed the following list in its request for a customs duty increase:

AiMeD also suggested disallowing the GST input credit of 12% for importers of items with 0% basic duty as per the ITA-1 List or where trade agreement renegotiation is impossible.

The association pointed to the 12-15% disabilities faced by indigenous manufacturers, as identified by the Department of Pharmaceuticals (DoP).

These include inadequate infrastructure, supply chain and logistics issues, high finance costs, quality power scarcity, limited design capabilities, and low focus on R&D and skill development.

"Currently, there is no mechanism to address these disabilities in the manufacturing of medical devices in India," AiMeD stated.

While initiatives by the Department of Biotechnology, Biotechnology Industry Research Assistance Council (BIRAC), NITI Aayog, and the office of Principal Scientific Advisor to the PM have helped create a nurturing ecosystem for startups, these entities face significant challenges when transitioning to MSME entrepreneurs.

"The disability factor needs to be neutralized as done for mobile phones, with a predictable tariff protection of at least 15% basic duty over the next two years," AiMeD noted.

AiMeD also highlighted the thriving manufacturing sectors of automobiles, motorcycles, and bicycles in India, which benefit from higher basic customs duties.

It urged the DoP to take decisive action similar to the Ministry of Electronics and Information Technology (MeitY), which has successfully boosted mobile phone manufacturing in India through a 20% basic customs duty imposed in 2018.

"Half-hearted measures will get halfway results. No action will result in further import dependency," the association added.